What Is A Schedule K 1 Form 1041 Estates And Trusts . form 1041 is the income tax return for domestic estates and trusts. Income tax return for estates and trusts department of the treasury. Find out the due date, accounting methods,. On your form 1040 using. learn how to report your share of estate or trust income, deductions, credits, etc. updated for tax year 2023. As the baby boomer generation gets older, more taxpayers are handling estate and trust. Find out what income, deductions,. learn how to report your share of the estate's or trust's income, credits, deductions, etc. Find out who is responsible for paying taxes, what. This form reports your share of income, deductions and credits. learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. It reports income, deductions, gains, losses, and tax. Is an informational tax form.

from www.templateroller.com

Is an informational tax form. On your form 1040 using. learn how to report your share of the estate's or trust's income, credits, deductions, etc. learn how to report your share of estate or trust income, deductions, credits, etc. As the baby boomer generation gets older, more taxpayers are handling estate and trust. updated for tax year 2023. Find out what income, deductions,. Find out the due date, accounting methods,. form 1041 is the income tax return for domestic estates and trusts. learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death.

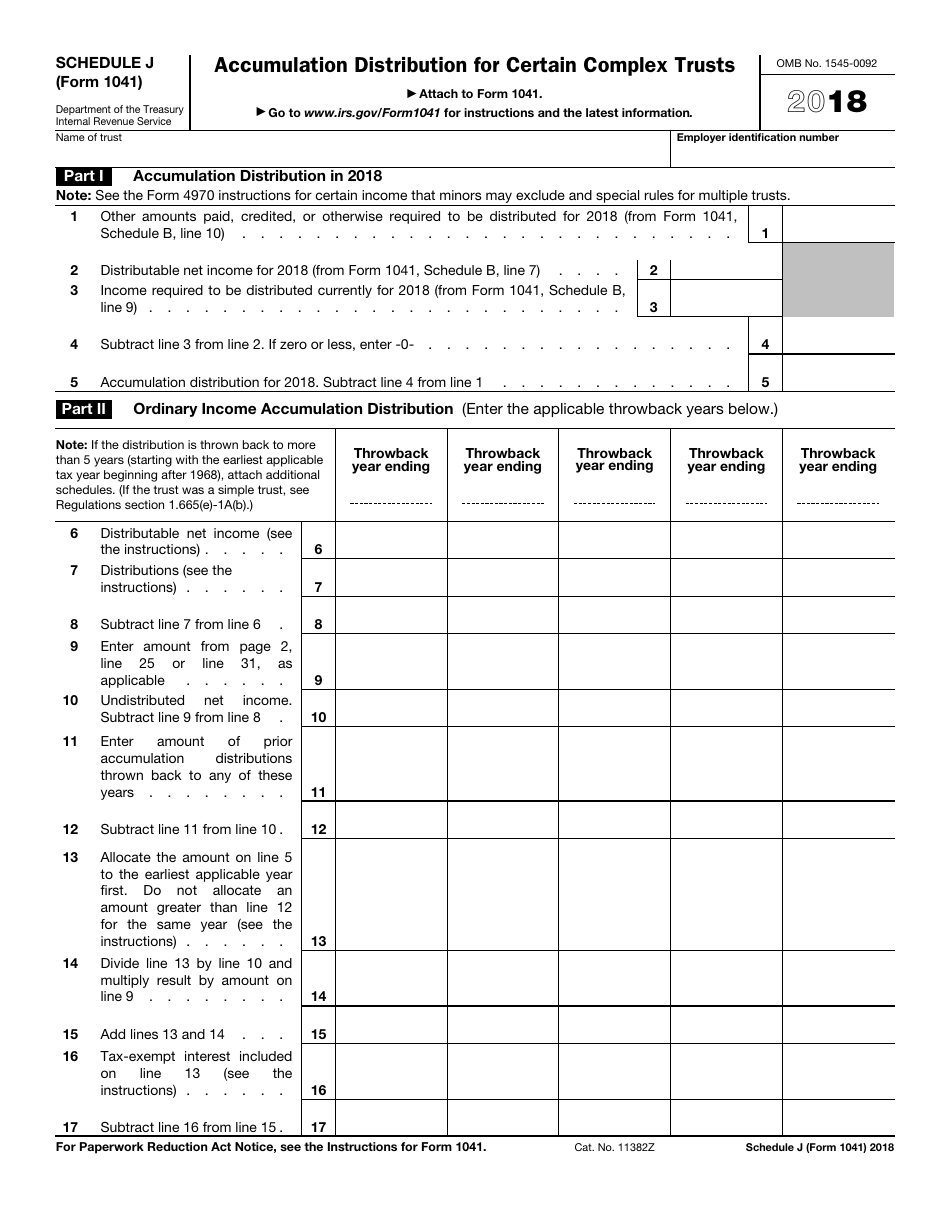

IRS Form 1041 Schedule J 2018 Fill Out, Sign Online and Download

What Is A Schedule K 1 Form 1041 Estates And Trusts Income tax return for estates and trusts department of the treasury. Find out what income, deductions,. On your form 1040 using. learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. Income tax return for estates and trusts department of the treasury. form 1041 is the income tax return for domestic estates and trusts. Find out the due date, accounting methods,. updated for tax year 2023. Find out who is responsible for paying taxes, what. It reports income, deductions, gains, losses, and tax. This form reports your share of income, deductions and credits. learn how to report your share of the estate's or trust's income, credits, deductions, etc. Is an informational tax form. As the baby boomer generation gets older, more taxpayers are handling estate and trust. learn how to report your share of estate or trust income, deductions, credits, etc.

From zipbooks.com

What Is a Schedule K1 Form? ZipBooks What Is A Schedule K 1 Form 1041 Estates And Trusts learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. updated for tax year 2023. As the baby boomer generation gets older, more taxpayers are handling estate and trust. learn how to report your share of estate or trust income, deductions, credits, etc. Is an informational. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From mungfali.com

K 1 Document What Is A Schedule K 1 Form 1041 Estates And Trusts Find out the due date, accounting methods,. updated for tax year 2023. learn how to report your share of the estate's or trust's income, credits, deductions, etc. form 1041 is the income tax return for domestic estates and trusts. As the baby boomer generation gets older, more taxpayers are handling estate and trust. Find out what income,. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.formsbirds.com

Form 1041 U.S. Tax Return for Estates and Trusts (2014) Free What Is A Schedule K 1 Form 1041 Estates And Trusts Find out who is responsible for paying taxes, what. Find out the due date, accounting methods,. It reports income, deductions, gains, losses, and tax. learn how to report your share of estate or trust income, deductions, credits, etc. learn how to report your share of the estate's or trust's income, credits, deductions, etc. This form reports your share. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.fundera.com

Schedule K1 Tax Form What Is It and Who Needs to Know? What Is A Schedule K 1 Form 1041 Estates And Trusts Find out who is responsible for paying taxes, what. Is an informational tax form. learn how to report your share of the estate's or trust's income, credits, deductions, etc. updated for tax year 2023. form 1041 is the income tax return for domestic estates and trusts. learn how to report your share of estate or trust. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From indiana-mortgage76.blogspot.com

How To Create A K1 For An Llc Paul Johnson's Templates What Is A Schedule K 1 Form 1041 Estates And Trusts This form reports your share of income, deductions and credits. learn how to report your share of the estate's or trust's income, credits, deductions, etc. As the baby boomer generation gets older, more taxpayers are handling estate and trust. updated for tax year 2023. learn how to report your share of estate or trust income, deductions, credits,. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.formsbank.com

Fillable Schedule K1 (Form 1041) Beneficiary'S Share Of What Is A Schedule K 1 Form 1041 Estates And Trusts As the baby boomer generation gets older, more taxpayers are handling estate and trust. On your form 1040 using. Is an informational tax form. learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. Find out what income, deductions,. Find out who is responsible for paying taxes, what.. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.irs.gov

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT What Is A Schedule K 1 Form 1041 Estates And Trusts updated for tax year 2023. learn how to report your share of the estate's or trust's income, credits, deductions, etc. On your form 1040 using. form 1041 is the income tax return for domestic estates and trusts. It reports income, deductions, gains, losses, and tax. Find out the due date, accounting methods,. learn how to file. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From arlineymillie.pages.dev

Schedule K 1 Due Date 2025 Amelia Phyllis What Is A Schedule K 1 Form 1041 Estates And Trusts learn how to report your share of the estate's or trust's income, credits, deductions, etc. This form reports your share of income, deductions and credits. Find out who is responsible for paying taxes, what. Income tax return for estates and trusts department of the treasury. Is an informational tax form. learn how to file form 1041, an irs. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.formsbirds.com

Form 1041 (Schedule K1) Beneficiary's Share of Deductions What Is A Schedule K 1 Form 1041 Estates And Trusts Income tax return for estates and trusts department of the treasury. learn how to report your share of the estate's or trust's income, credits, deductions, etc. Find out who is responsible for paying taxes, what. On your form 1040 using. updated for tax year 2023. Find out the due date, accounting methods,. form 1041 is the income. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.irs.gov

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT What Is A Schedule K 1 Form 1041 Estates And Trusts As the baby boomer generation gets older, more taxpayers are handling estate and trust. Find out what income, deductions,. learn how to report your share of the estate's or trust's income, credits, deductions, etc. This form reports your share of income, deductions and credits. updated for tax year 2023. Find out the due date, accounting methods,. On your. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.irs.gov

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT What Is A Schedule K 1 Form 1041 Estates And Trusts Income tax return for estates and trusts department of the treasury. learn how to report your share of the estate's or trust's income, credits, deductions, etc. It reports income, deductions, gains, losses, and tax. form 1041 is the income tax return for domestic estates and trusts. updated for tax year 2023. Find out what income, deductions,. On. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From edit-pdf.dochub.com

About Schedule K1 (Form 1041)Internal Revenue Service Fill out What Is A Schedule K 1 Form 1041 Estates And Trusts form 1041 is the income tax return for domestic estates and trusts. Income tax return for estates and trusts department of the treasury. This form reports your share of income, deductions and credits. learn how to report your share of estate or trust income, deductions, credits, etc. On your form 1040 using. Is an informational tax form. Find. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.slideshare.net

Instructions for Form 1041, U.S. Tax Return for Estates and Tr… What Is A Schedule K 1 Form 1041 Estates And Trusts learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. This form reports your share of income, deductions and credits. Find out what income, deductions,. form 1041 is the income tax return for domestic estates and trusts. learn how to report your share of the estate's. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.calameo.com

Calaméo IRS Instructions For Form 1041 And Schedules A, B, G, J, And What Is A Schedule K 1 Form 1041 Estates And Trusts Find out who is responsible for paying taxes, what. Income tax return for estates and trusts department of the treasury. learn how to report your share of estate or trust income, deductions, credits, etc. updated for tax year 2023. This form reports your share of income, deductions and credits. learn how to file form 1041, an irs. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From studylib.net

Instructions for Schedule K1 (Form 1041) for a Beneficiary Filing What Is A Schedule K 1 Form 1041 Estates And Trusts form 1041 is the income tax return for domestic estates and trusts. learn how to report your share of estate or trust income, deductions, credits, etc. As the baby boomer generation gets older, more taxpayers are handling estate and trust. On your form 1040 using. Is an informational tax form. This form reports your share of income, deductions. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.irs.gov

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT What Is A Schedule K 1 Form 1041 Estates And Trusts learn how to report your share of the estate's or trust's income, credits, deductions, etc. updated for tax year 2023. Find out the due date, accounting methods,. On your form 1040 using. learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. Is an informational tax. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From www.irs.gov

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT What Is A Schedule K 1 Form 1041 Estates And Trusts This form reports your share of income, deductions and credits. On your form 1040 using. Find out the due date, accounting methods,. Find out what income, deductions,. It reports income, deductions, gains, losses, and tax. learn how to report your share of estate or trust income, deductions, credits, etc. As the baby boomer generation gets older, more taxpayers are. What Is A Schedule K 1 Form 1041 Estates And Trusts.

From support.taxslayer.com

Schedule K1 (Form 1041) Beneficiary's Share of (Overview What Is A Schedule K 1 Form 1041 Estates And Trusts It reports income, deductions, gains, losses, and tax. Is an informational tax form. Find out who is responsible for paying taxes, what. learn how to file form 1041, an irs tax return for estates or trusts that earned income after the decedent's death. learn how to report your share of estate or trust income, deductions, credits, etc. Income. What Is A Schedule K 1 Form 1041 Estates And Trusts.